For any organization, nonprofit or otherwise, having a well-planned budget is crucial to success. Having your finances in order lets you plan ahead, keeps your organization and its programs running, and lays a foundation for where the organization is headed for the year.

Quick Case StudyIn the case of one of our clients, a nonprofit organization with 15-20 overnight staff and budget of $1 million, they were estimating a large deficit in their budget in the upcoming year. However, by diligently working alongside their executive director and board, we re-evaluated all aspects of their budget and got their finances in order. This process led to a $200,000 decrease in estimated costs for the upcoming fiscal year. |

How early should you start planning your budget?

Building a budget is no small task: it’s a process that takes time and demands you be thorough, considering several variables. Getting started early will help take some of the pressure off, and give you plenty of time to make sure you get your budget in good shape.

We recommend three to six months prior to the start of the budget year. This timeline will ensure your board has ample time to review, revise, and approve the final budget. During this time, you’ll also want to confirm your revenue sources for the coming year, including talking to your funders and lining up any official documentation that backs up your sources.

Whether this is your first time creating a budget, or you just want a checklist to work off of, here are seven steps to follow when you’re building your budget for next year:

1) Analyze your current financial status

You need to know where you are before you figure out where you’re going. Take the time to review your income and expenses for the current year against your existing budget. This will help you get a better sense of any variances. Make sure you understand this information before moving forward. Ask yourself: does our chart of accounts provide the appropriate level of detail? If not, get that fleshed out first.

2) Make a plan

Before you dive into creating your budget, you want to set yourself up for success. Your budget plan should include:

- Timeline — Make sure you’ve allotted enough time to have the budget reviewed and approved by your board

- Budget method — Are you building a top-down or bottom-up budget? Not sure? Learn more here

- Key players — Who needs to be consulted during the budgeting process?

- Breakdown — Is it important for your organization to break the budget down by month? Quarter? Six months?

- Notes — Keep track of all assumptions so that you can revisit them in a year’s time

3) Forecast next year’s operating income and expenses

Your forecasts don’t have to be perfect, but they should be sound and based on good evidence, not just shots in the dark. Break down your budget based on the programs your organization runs to make sure you have the funding necessary for each one. Throughout this process, you’re also trying to identify any programs that are underfunded. In these cases, ask yourself: Do we continue with the program and find additional income sources? Or do we cancel the program?

You’ll also want to consider the fiscal year of funding. If your organization relies on grants, you want to factor in the timing and renewal of those funding sources and note if/how that impacts your revenue.

4) Don’t forget your staff

Though staffing technically falls under operating expenses, it is typically one of the largest expense categories for a nonprofit. Some things you should consider when working on your staffing budget include:

- Wage adjustments — Are there any raises on the horizon?

- Benefits — Do you anticipate an increase in benefit costs? Is the board considering changing the level or types of benefits offered?

- Employment taxes — This includes things like unemployment, FICA, workers comp, etc.

- Hours worked per week — Take full time, part-time, and overtime into account

- Potential savings from employee turnover — i.e. How long does it take your organization to refill a position once it’s been vacated? Once a new employee is hired, is there a waiting period before benefits commence?

Don’t forget to allocate staff expenses to each program your organization supports based on the estimated time spent on each program!

5) Forecast next year’s capital expenses

A capital expense is any large purchase, such as equipment or property. The proper way to include a capital expense in your operating budget is to record it as an asset on the balance sheet, then expense it over the course of its entire useful life rather than just the fiscal year purchased.

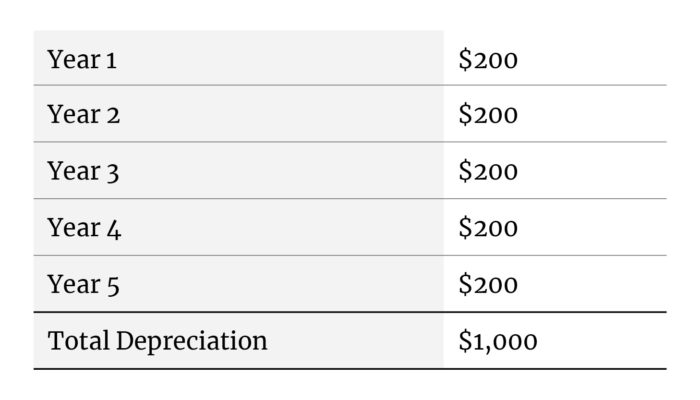

Let’s say, for example, that your organization purchases $1000 worth of new computers that are expected to be used over the next 5 years. These would first be recorded as assets on the current balance sheet, and then depreciated by $200 over the next 5 years.

6) Set saving goals

Does your organization have any reserves? If so, analyze the current levels and ensure they’re sufficient to meet the organization’s needs. The levels needed will vary depending on the individual organization’s funding structure. For example, an organization that relies heavily on donations (e.g. Red Cross) will need to have higher reserves, as opposed to a nonprofit with a more reliable funding source. As a general rule, we advise a minimum of three months’ worth of expenses for adequate reserves.

Also consider: does your organization have an established reserve policy? If not, should it?

7) Communicate with key stakeholders

As mentioned above, your board of directors has final approval over your budget. Depending on the nature of your organization, you may want (or need) to have the budget reviewed by outside partner agencies or even your management team as well. To make this step as efficient as possible, ensure you have a plan on how the approval process works, including key dates that need to be adhered to in order for the budget to be completed and approved in time for the new fiscal year.

Why planning ahead matters

Taking the time to build your budget properly will make a big impact in the long run. Going back to the client example mentioned at the start of this article:

| The organization had put together a budget that looked healthy at a glance but was actually built on educated guesses informed by previous years without taking potential future changes into consideration. This meant they didn’t have an accurate picture of what their financial position really was. While it looked like they had adequate reserves set aside on paper, it turns out those reserves were made up of non-cash assets. In the case of an emergency, those assets would take time to convert to cash, and what they did have in cash was going to be eaten up by a large projected deficit.We were able to step in and take over their budgeting process and, by working with their management team, we created a budget that gave them an accurate picture of the state of the organization. |

If you think your organization’s budget would benefit from a second look, shoot us a quick message. We’re here to help!